5 Steps to Implement a Frictionless Payment Acceptance Strategy

April 01, 2024

The payments industry is one of the most dynamic in the fintech space, and technology is constantly driving change. In today's rapidly evolving fintech landscape, the payments industry continues to be a center of innovation. This article explores a crucial aspect of success in this dynamic environment: implementing a frictionless digital payment acceptance strategy for your business.

The Benefits of Frictionless Payments

Frictionless payments offer a smoother experience for both merchants and consumers, with increased flexibility, convenience, and security when processing payments. They're becoming increasingly popular, and Statista predicts the Digital Payments market to reach a staggering $15 trillion by 2027.

Here are 5 key steps to help you implement a frictionless digital payment acceptance strategy:

1. Expedite Payment Acceptance

-Offer contactless payments: Contactless payments using NFC technology allow customers to pay simply by tapping their phone or card on a reader, reducing transaction times and queues.

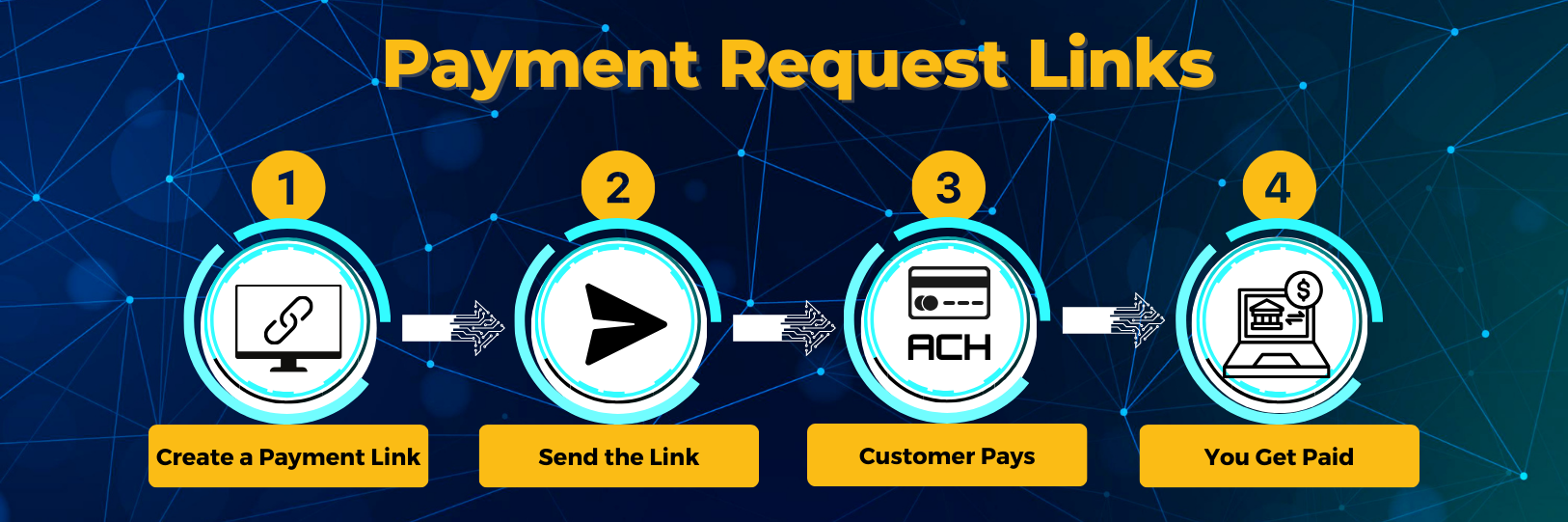

-Accept unconventional methods: Consider offering popular contactless payment methods like Apple Pay or Google Pay. Additionally, explore ACH payments and auto debits for faster processing compared to checks.

-Embrace omnichannel payments: Integrate multiple payment channels (online, mobile, in-store) to give customers the flexibility to pay anytime, anywhere. Studies show omnichannel shoppers spend significantly more than those using a single channel.

-Reduce manual data entry: Utilize system integrations to eliminate the need for manual data entry across different platforms. This streamlines order processing and reduces errors.

-Automate cash application: Automate the process of matching incoming customer payments to invoices, saving time and resources.

2. Accept Payments on the Go

-Mobile point-of-sale: Equip employees with tablets or mobile devices to accept payments anywhere in your store or even out in the field. This enhances customer experience for in-person transactions beyond the traditional checkout counter.

-Mobile check deposits: Allow employees to deposit checks quickly and easily by taking a picture with a phone’s or tablet’s camera. This eliminates the need for housing physical checks and streamlines the deposit process.

3. Online Payment Adoption

-The rise of Gen Z: Gen Z is a powerful force in the online payment space. They gravitate towards digital tools like person-to-person payments and mobile wallets, demanding a highly relevant and personalized experience.

-Digital commerce boom: The pandemic accelerated the growth of e-commerce, and online payment adoption continues to rise. Businesses must cater to at-home shoppers or payors by offering a variety of secure online payment options.

-QR codes: QR codes allow contactless payments by having customers scan a code with their smartphone. This is a convenient and secure option that gained popularity during the pandemic.

4. Reduce Security Concerns

-Tokenization: Tokenization replaces sensitive payment information with a random ID (token), ensuring customer data is never stored on your servers. This reduces your PCI compliance obligations and protects against data breaches.

-Point-to-Point Encryption (P2PE): P2PE encrypts sensitive payment data during transmission, protecting it from unauthorized access even if intercepted. This simplifies PCI compliance assessments for businesses.

-Secure sensitive data: Implement procedures for handling and disposing of sensitive customer data. Regularly train employees on data security best practices to minimize the risk of breaches.

5. Reduce Payment Fraud Risk

-Combat new account fraud: New account fraud involves using stolen data to open new accounts. EMV chip and pin technology in credit cards helps prevent this by making it harder to counterfeit cards.

-Utilize anti-fraud tools: Leverage anti-fraud tools offered by your payment provider. Don't bypass security measures like address verification or CVV validation to save time.

-Guarantee ACH and check payments: Consider using a service that protects you from returned checks and fraudulent ACH payments, mitigating financial losses.

By following these steps, you can create a frictionless payment acceptance strategy that improves customer experience, increases sales, and protects your business from fraud. Remember, the needs of modern consumers are constantly evolving, and offering a seamless payment experience is crucial for success in today's competitive market.

Payments for Success: Partner with UTA

Seamless payments are key to gaining efficiencies in today's market. United TranzActions (UTA) is your trusted partner for frictionless solutions.

For over 31 years, UTA has provided innovative payment processing. We offer:

-Everything you need: Credit card, ACH, check processing – all in one solution.

-Customizable solutions: We tailor our offerings to your specific business needs.

-Guaranteed ACH & checks: Reduce your risk of fraud and returned transactions.

-Modern solutions: Online Bill Pay & QR Code platforms simplify customer payments.

-Frictionless acceptance: Accept payments anywhere – phone, in-store, online, or mobile.

-Enhanced security: We prioritize security with cutting-edge technology.

-Reduced fees: We help you optimize fees and recover costs.

Partner with UTA and empower a customer-centric experience with speed, flexibility, and convenience.

Mark Tapia

Vice President Business Development

mtapia@unitedtranzactions.com

800.858.5256 ext 3028.

Direct: 786.264.7028.