ACH Processing

Here you will find everything you need to know about ACH, if you need more help please contact us.

UTA’s ACH program enables the Credit Manager to accept a payment from their customer right over the phone, without actually needing the paper check in hand.

ACH is designed to positively impact every measurement of accounting performance in the Credit Manager’s department.

There are many benefits including increased ability to get paid when performing collection calls, primarily because it takes the mystery and guesswork out of knowing if your customer will actually mail you a check or not. Other important benefits are improved A/R aging, lower DSO and increased cash flow.

For many, paying over the phone is a more convenient way to pay. It allows customers to pinpoint exactly when they want the payment to take place, to allow the payment to coincide with the availability of funds. Your customer can feel that they are in control. The customer’s bank data is secure and protected electronically. Processing paper checks involves so much handling that they are in many ways less secure. It eliminates the trouble and cost of preparing a check and sending it by mail, overnight delivery or wire transfer.

UTA’s 24/7 hour website offers full reporting screens of your account, allowing you to view full detail of all transactions, along with the ability to monitor the exact timeline of the funds being credited to your account, and/or any returns you may experience. These reporting screens are accessible to you. In addition, you control the security of these reports and who has access to them. We also provide email notification at each step of the transaction.

Typically two business days. For instance, if you submit a transaction on Monday (7:30 PM cutoff time-Eastern Time), it will be batched out to the Federal Reserve that night. The funds will be transferred into your account Tuesday evening (the Fed does its work at night) and would be liquid and available on Wednesday morning. Please note that the Federal Reserve follows normal banking holidays.

For NSF returns, you have the option of resubmitting that item two additional times. You may wish to try to "time" the redeposits strategically when you think your customer may have money in their account. With an administrative return, you are able to retrieve the transaction on the reporting side of the website, make the needed correction, and resubmit it through the system again.

Yes. You can set them up for recurring monthly payments for up to 60 months in advance. You can set them up for a series of weekly or semiweekly payments for as many as 52 weeks. You also have the option of setting up a series of unlimited numerous payments for varying dates and amounts in the future.

No monthly minimum.

None. You simply go to UTA’s secure website and enter your personal Login ID and Password.

No. There is no obligation or time binding contract on your part.

No.

Yes. Simply contact our office at 800-858-5256 and we will be happy to schedule a 15-minute web demo at your convenience.

UTA will send you the necessary forms. First, our Service Agreement, (terms and conditions); second, our Subscriber Application, (your banking information that allows us to set up ACH credits to your designated account) and third, our User Data Form (Login ID’s, Passwords, etc…).

UTA’s ACH with Guarantee program enables the company to accept AND guarantee a payment from their customer right over the phone, without actually needing the paper check in hand.

ACH with Guarantee will allow you to: 1. Release products and/or services immediately without fear of a returned payment. 2. Eliminate the need to have your driver meet your customer to accept a check. 3. Prevent the delays associated with receiving payments from common carriers (UPS, FedEx, etc.). 4. Costs 40% less than credit card processing costs.

For many, paying over the phone is a more convenient way to pay. It allows customers to pinpoint exactly when they want the payment to take place, to allow the payment to coincide with the availability of funds. Your customer can feel that they are in control. The customer’s bank data is secure and protected electronically. Processing paper checks involves so much handling that they are in many ways less secure. It eliminates the trouble and cost of preparing a check and sending it by mail, overnight delivery or wire transfer.

After logging into UTA’s website, the authorized user submits the minimal amount of information from their invoice and transfers funds electronically from their customer’s account, via the Federal Reserve, to their own company’s bank account as an ACH credit. “You have just made a deposit in your account with no chance of a return!!”

YES! We created the program to make your payment processing simple so you can focus on your business. No software or hardware is required. Businesses can begin accepting electronic transactions in just a few days.

It makes the payment process simpler and faster. Often times, your customers may even request to pay you over the phone to eliminate the need for writing a check, creating a wire-transfer, meeting the “FedEx”(or any other carrier) driver, or leaving a check with someone.

Yes, similar to a credit card the customer’s authorization is required. UTA provides a sample authorizations form for you to use. The authorization may be obtained from your customer by either a written agreement, fax, email, web, or verbal authorization.

Typically two business days. For instance, if you submit a transaction on Monday (7:30 PM cutoff time-Eastern Time), it will be batched out to the Federal Reserve that night. The funds will be transferred into your account Tuesday evening (the Fed does its work at night) and would be liquid and available on Wednesday morning.

Seconds. Once your customer’s transaction information is entered, UTA's system will process the data and, if approved, provide you with a transaction number within seconds.

This is the good news! Your approved transactions are fully guaranteed meaning you will never experience another returned item. You can have full confidence that the payment is complete.

No. ACH with Guarantee can only be used for cash sales or cash on delivery (COD) for goods or services.

Absolutely! You have the ability to set up any or all of your customers into a customer profile database. When you choose to do an ACH simply enter the customer number and it will generate an auto-fill function completing all of the necessary fields other than the dollar amount, payment date, and memo field.

Yes. The ACH with Guarantee system allows you to send an e-mail confirmation to your customer instantly. You will also be sent an email confirmation of the transaction and any additional recipients in your company.

You will be able to track your payment and the remittance information that is attached to the payment record via UTA’s comprehensive reporting tools. Additionally, you can even download files that contain this data and use them for automated cash application purposes or allow us to feed it directly into your accounting/ERP system.

YES! Customers have reported considerable cost savings in all aspects of their business after switching to ACH with Guarantee. You can save about 30%-40% less than the cost of a credit card transaction.

Our services are fully supported so you can use the system with confidence. All customers receive unlimited free technical support and training from a live representative over the phone. Our call center is operational 24 hours a day, 7 days a week simply contact us at 800-858-5256. It's just one more way we make payment processing easy!

For many, paying over the phone is a more convenient way to pay. It allows customers to pinpoint exactly when they want the payment to take place, to allow the payment to coincide with the availability of funds. Your customer can feel that they are in control. The customer’s bank data is secure and protected electronically. Processing paper checks involves so much handling that they are in many ways less secure. It eliminates the trouble and cost of preparing a check and sending it by mail, overnight delivery or wire transfer.

our products

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

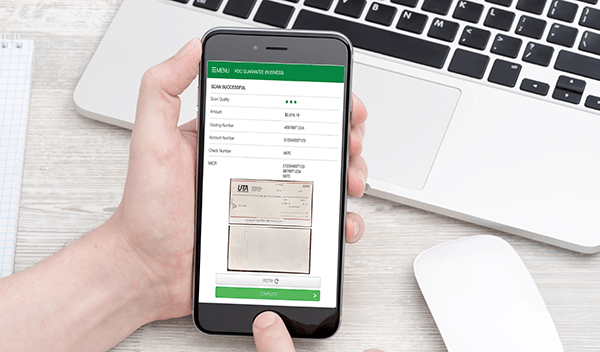

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.