Accounts Payable

Here you will find everything you need to know about Digital A/P, if you need more help please contact us.

An A/P payment processing solution is a software or platform designed to streamline and automate the accounts payable (A/P) process. It helps merchants manage vendor invoices, make electronic payments, and maintain accurate records, thereby enhancing efficiency and reducing manual errors.

Our Digital A/P payment processing solution enables you to capture, route, and approve invoices digitally. The solution automates payment creation, allows for electronic payment methods such as ACH, and streamlines reconciliation and payment posting.

- Increased efficiency: Automation reduces manual data entry and streamlines the payment approval process.

- Cost savings: By eliminating paper-based processes, you save on printing, postage, and storage costs.

- Improved accuracy: Automation reduces human errors and provides better visibility into payment status.

- Enhanced security: Electronic payments offer secure transmission of sensitive financial information.

- Better vendor relationships: Timely payments and improved communication lead to stronger partnerships.

UTA's Digital A/P solution is beneficial for businesses of all sizes and industries that regularly handle vendor invoices and payments. Whether you're a small business looking to streamline your processes or a large enterprise seeking to scale and optimize your accounts payable function, an A/P payment processing solution can be customized to meet your specific needs.

Yes, UTA offers customization options to align with your business requirements. You can typically configure approval workflows, payment methods, and reporting parameters according to your organization's unique processes.

None. You simply go to UTA's secure web portal and enter your assigned Login ID and Password to gain access.

Yes, our Digital A/P payment processing solution offers integration capabilities with popular accounting software such as QuickBooks, Xero, NetSuite, SAP, and others. This integration allows for seamless data flow between systems, minimizing manual data entry and ensuring accurate financial records.

Our reputable Digital A/P payment processing solution prioritizes data security and employs various measures to protect sensitive financial information. UTA offers encryption, secure data centers, and compliance with industry standards such as PCI DSS (Payment Card Industry Data Security Standard).

The implementation time can vary depending on the complexity of your existing systems and the level of customization required. It can range from a few days to several weeks. It is advisable to work closely with one of our solution providers to establish a realistic timeline based on your specific needs.

UTA's 24/7-hour web portal offers a comprehensive, centralized reporting module, allowing you to view full transaction details, along with the ability to monitor the exact timeline of the funds being credited to your account and/or any exceptions you may experience. In addition, you control the security of these reports and who has access to them. We also provide email notifications at each step of the transaction.

Typically, it takes anywhere between two to three business days. Please note that the Federal Reserve follows normal banking holidays.

Yes. You can set them up for recurring monthly payments up to 60 months in advance. You can set them up for a series of weekly or semiweekly payments for as many as 52 weeks. You also have the option of setting up a series of unlimited numerous payments for varying dates and amounts in the future.

This will vary based on your processing volume.

No.

UTA will send you the necessary forms. First, our Service Agreement, (terms and conditions); second, our Subscriber Application, (your banking information that allows us to set up ACH transactions from your designated account) and third, our User Data Form (Login IDs, Passwords, etc…).

Seconds. Once your vendor's transaction information is entered, UTA's system will process the data and, if approved, provide you with a transaction number within seconds.

Absolutely! You have the ability to set up any or all of your vendors in a vendor profile database. When you choose to process a payment, simply enter the vendor number and it will generate an auto-fill function completing all of the necessary fields other than the dollar amount, payment date, and memo field.

Yes. UTA system allows you to send an email confirmation to your vendor instantly. You will also be sent an email confirmation of the transaction, including any additional recipients in your company.

You will be able to track your payment and the remittance information that is attached to the payment record via UTA's comprehensive reporting tools. Additionally, you can even download files that contain this data and use them for automated debit application purposes or allow us to feed it directly into your accounting/ERP system.

YES! Merchants have reported considerable cost savings in all aspects of their business after switching to electronic payments. You can save up to 86% compared to the cost of paper checks.

Our services are fully supported, so you can use the system with confidence. All merchants receive unlimited free technical support and training from a live representative over the phone. Our call center is operational 24 hours a day, 7 days a week. Simply contact us at 800-858-5256. It's just one more way we make payment processing easy!

our products

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

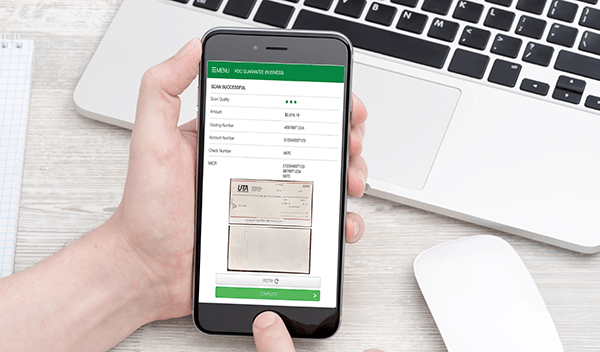

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.