Credit Card Surcharging

Here you will find everything you need to know about Credit Card Surcharging.

A payment surcharge, also known as a check out fee, is an additional fee that a merchant adds to a customer's bill when he or she uses a credit card for payment.

Merchant surcharging is allowed on credit card transactions only. It is NOT allowed on debit cards (signature or PIN-based). For example, a Visa credit card transaction can utilize surcharging, but a Visa debit card (i.e Visa check card) cannot utilize surcharging in any way. Visa and MasterCard check cards do not allow surcharging, whether processed as a Credit Card Sale (signature) or a Debit Card Sale.

Merchant Surcharging is allowed on all-card present and card-not-present industry types (including recurring transactions).

A surcharge policy will be disclosed at the point of store entry and point of sale or verbally communicated during phone payments prior to a purchase transaction being completed. The surcharge policy may also be disclosed on an invoice.

Visa, MasterCard, American Express, and Discover all support merchant surcharging, though note that merchant surcharging rules should be reviewed on the payment brand websites. Each payment brand requires that merchants register to support surcharging functionality.

A surcharge fee must be applied to all credit card paying customers, whenever allowed by federal and state law. Debit Cards, Gift Cards, and Pre-paid cards may not be surcharged under any conditions.

Merchants may add a surcharge fee that does not exceed the cost of accepting and processing the credit card transaction. In no event can the merchant assess a surcharge above 4%.

If you need more help please contact us.

our products

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

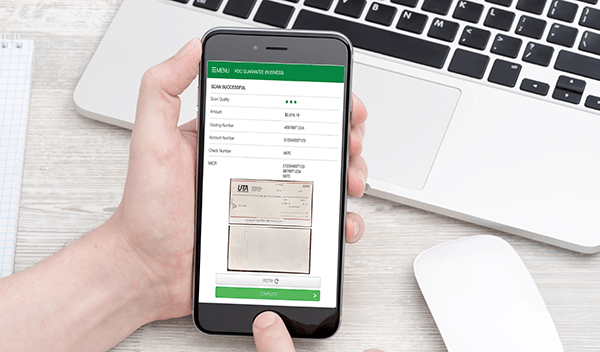

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.