EMV Credit Card Processing

Here you will find everything you need to know about EMV credit card processing.

EMV (Europay, Mastercard, and Visa) also known as a smart card, chip an pin or chip and sign card. Is a fraud-reducing technology that helps protect issuers, merchants and consumers against losses from the use of counterfeit and lost or stolen payment cards at the point-of-sale.

It's that small, metallic square you'll see on new cards. That's a computer chip, and it's what sets it apart from the new generation of cards. The magnetic stripes on traditional credit and debit cards store contain unchanging data, unlike EMV cards that every time we use them for payment, the card chip creates a unique transaction code that cannot be used again. Experts hope it will help significantly reduce fraud in the U.S., which has doubled in the past seven years as criminals have shied away from countries that already have transitioned to EMV cards.

EMV cards are processed for payment in two steps: card reading and transaction verification. However, with EMV cards you no longer have to master a quick, fluid card swipe in the right direction. Chip cards are read in a different way. Instead of going to a register and swiping your card, you are going to do what is called 'card dipping' instead, which means inserting your card into a terminal slot and waiting for it to process.

Not necessarily. EMV cards can also support contactless card reading, also known as near field communication. Instead of dipping or swiping, NFC-equipped cards are tapped against a terminal scanner that can pick up the card data from the embedded computer chip.

You will have to do one of those verification methods, but it depends on the verification method tied to your EMV card, not if your card is debit or credit. Chip-and-PIN cards operate just like the checking-account debit card you have been using for years. As with a magnetic-stripe credit card, you sign on the point-of-sale terminal to take responsibility for the payment when making a chip-and-signature card transaction.

If an in-store transaction is conducted using a counterfeit, stolen or otherwise compromised card, consumer losses from that transaction fall back on the payment processor or issuing bank, depending on the card's terms and conditions.

Yes. The first round of EMV cards -- many of which are in consumers' hands -- will be equipped with both chip and magnetic-stripe functions so consumer spending is not disrupted and merchants can adjust. If you find yourself at a point-of-sale terminal and are not sure whether to dip or swipe your card, have no fear. The terminal will walk you through the process.

EMV transactions can be authorized online or offline. For an online authorization, transaction information is sent to the issuer, along with a transaction-specific cryptogram, and the issuer either authorizes or declines the transaction in real time.

Card-not-present transactions are currently not in the scope of EMV. Since there is no card-terminal interaction, no cryptogram is created (a cryptogram is a coded alphanumeric value that is the result of data elements entered into an algorithm and then encrypted, commonly used to validate data integrity).

Merchants are still required to maintain on-going PCI compliance, but may be eligible for a waiver of the annual PCI validation process.

- EMV chip cards are used; and

- EMV chip-enabled acceptance devices/applications are deployed, including in-person POS retail devices, unattended terminals ( including ATMs and AFDs) , kiosks and vending machines, and mobile payment acceptance devices (MPOS)

The counterfeit card liability shift only pertains to transactions where a counterfeit magnetic stripe is presented to a POS terminal that does not support, at a minimum, contact chip EMV.

If you need more help please contact us.

our products

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

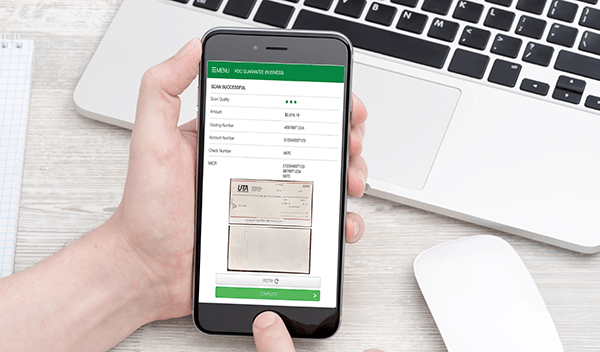

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.