Credit Card

Here you will find everything you need to know about Credit Card Processing, if you need more help please contact us.

Generally speaking, the difference lies in the back-end reporting and controls that the buying company sets up for each cardholder. Business Card: geared towards small businesses, Corporate Card: geared towards corporations for T&E (travel & entertainment), Purchasing Card: used as a purchasing vehicle.

Credit Cards are cards that utilize revolving credit where the cardholder pays the bill at the end of each month. The transactions require a signature if the card and cardholder are present at the time of the sale. Debit Cards deduct the money for the purchases directly from the cardholder’s checking account. No bill is paid at the end of the month as the sales have already been debited from the checking account.

Visa and MasterCard charge a processing or “interchange” fee on every sale. Interchange is paid to the cardholder’s issuing institution and reflects processing expenses, including the cost of credit and fraud losses. The type of card presented, the type of business accepting the card, and the processing environment determine this fee.

Assessment is the amount paid to the Visa and MasterCard associations. Unlike Interchange that is paid to the card issuing institution, assessment is paid to Visa and MasterCard. Again, all acquirers/processors must pay the same assessments.

Per Visa and MasterCard’s regulations you are not allowed to charge a fee or pass back the interchange to the cardholder for accepting their card for payment.

With the settlement of the “WalMart” lawsuit, merchants do have a choice on what types of Visa and MasterCard cards they accept at the point of sale. You may elect to accept Credit Cards only, Debit Cards only or all cards.

Depending on the network, Level II data may refer to Sales Tax and Customer Code. Customer Code is a code provided by the cardholder to you at the time of the sale and typically refers to a cost center, PO number or GL code the cardholder’s company uses to allocate expenses.

Level III is the line item detail specific to the transaction purchase. This includes item description, item quantity, product code, and price among the required elements. The line item detail is passed from the merchant/supplier to the cardholder/customer via a purchasing card. Purchasing Cardholders are able to electronically receive the line item detail and reconcile the purchase order.

Both Visa and MasterCard offer a Large Ticket incentive interchange rate based on the value of the transaction.

There are many cost effective Level III capable solutions for you to choose. The solution is as simple as our virtual terminal via the Internet or PC software.

our products

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

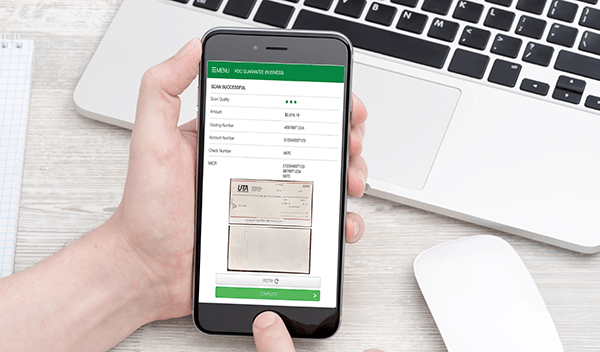

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.